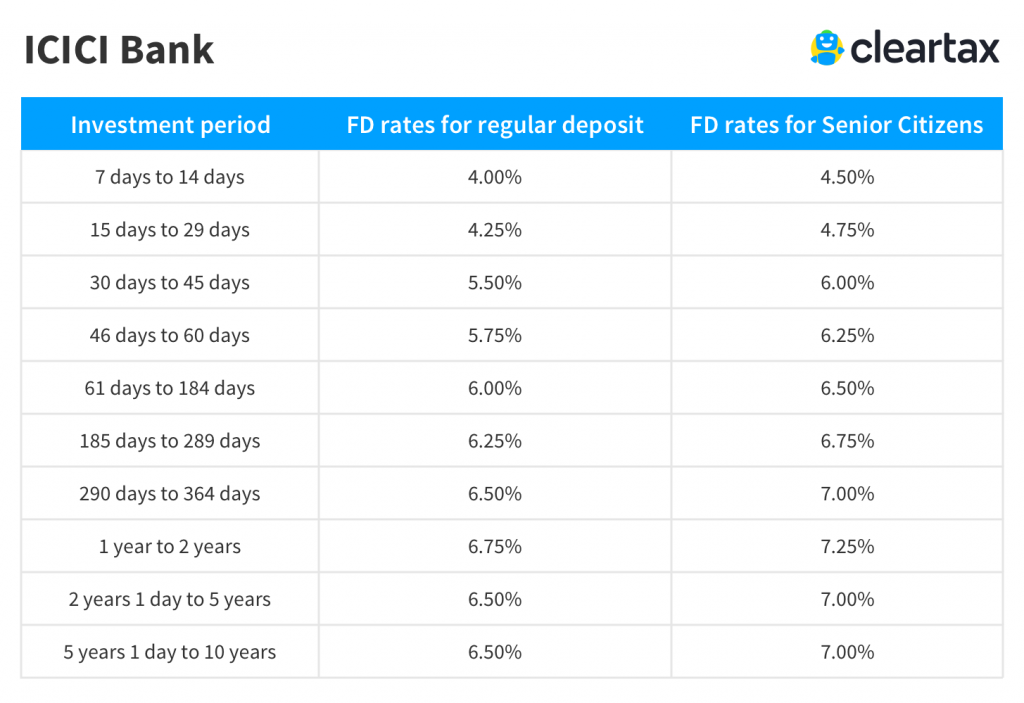

FD (Fixed Deposit) Interest Rates Offered By SBI, ICICI Bank, HDFC Bank Compared Fixed deposits (FDs) are popular among investors because they offer regular rates of interest. Business NDTV Profit. ICICI Bank FD Interest Rates March 2021. Fixed deposits are available to general as well as senior citizens with one of the highest interest rates on the Fixed Deposit account. The fixed deposit scheme of ICICI bank is available with a premature withdrawal facility as well as without a premature withdrawal facility. 1 day ago announced on Friday that it has reduced home loan interest rate to 6.70%.The revised interest rate is effected from March 5, 2021, stated the bank in a press release. Customers can avail of this interest rate for home loans up to Rs 75 lakh. For loans above Rs 75 lakh, interest rates. Check out the latest fixed deposit rates in SBI, ICICI Bank, HDFC Bank, PNB and Axis Bank. FD interest rates SBI (below Rs 2 crore) effective January 8, 2021: SBI FDs between seven to 45 days will. ICICI fixed deposit interest rate for tax saver FD is 5.35% for regular citizens whereas it is 5.85% for senior citizens. For short term FDs, i.e. Ones maturing in 1 year ICICI Bank offers interest rates at 4.90% and for longer duration like 3, 5 and 10 years, it is 5.15%, 5.35% and 5.50% currently (0.50% preferential for senior citizens).

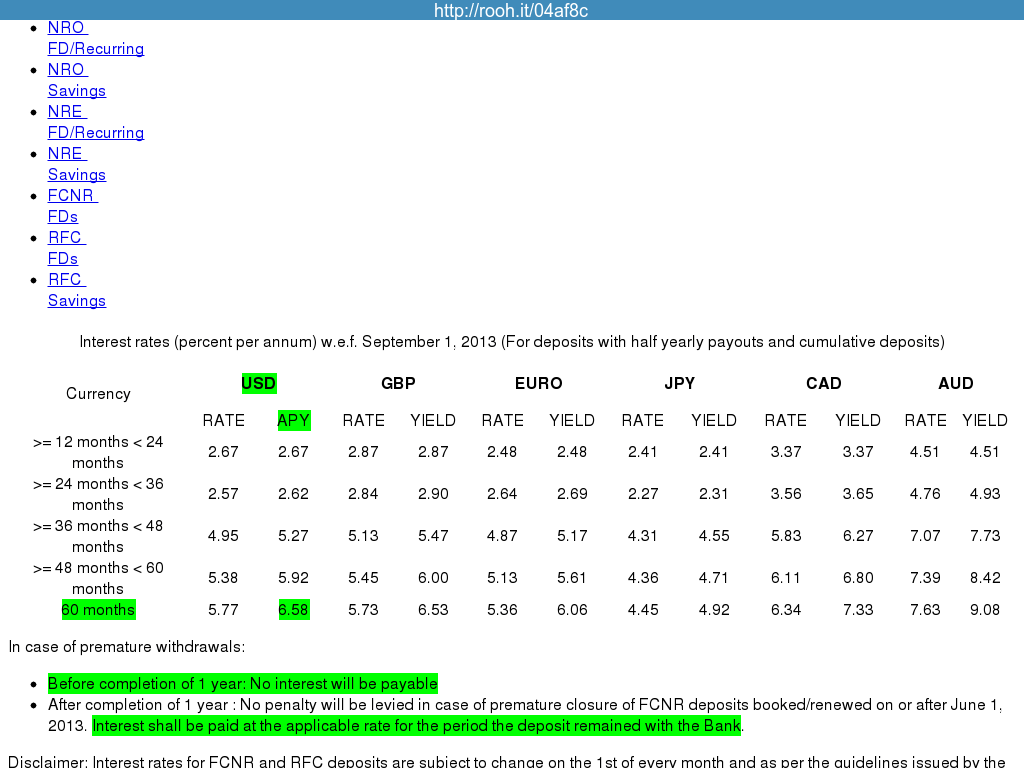

Find Icici Bank NRE FD Interest Rates (as on 06 Mar 2021). The interest rates for below 1 crore and above 1 crore on fixed deposit depend on which category you fall under and your choice between different banks.

Icici Bank offers NRO Fixed deposit interest rates to NRI customers from 1 year to 5 plus years. Find Icici Bank FD interest for NRO customer from below list.

Icici Bank provides different services to its customers some of them are Home loan,Personal loan,Car loan,Two Wheeler loan, Gold loan. You can get Icici Bank IFSC Code,MICR Code, Swift Code for NEFT, RTGF fund transfer.

Icici Bank NRE FD Interest Rates Rs 1 Crore (as on 06 Mar 2021)

Disclaimer: The NRE Fixed Deposit Interest Rates keep on changing. You are advised to check the interest rates with banks before making your FD. Source: Bank WebsitesOther Banks NRE FD Interest Rates Rs 1 Crore

Disclaimer: The NRE Fixed Deposit Interest Rates keep on changing. You are advised to check the interest rates with banks before making your FD. Source: Bank WebsitesTable of Contents

- 1 About ICICI Home Finance Company Fixed Deposit

- 1.1 Important features and advantages of ICICI HFC fixed deposit

About ICICI Home Finance Company Fixed Deposit

ICICI Home Finance Company offers retail fixed deposit to investors. It is one of the safest and most profitable saving scheme for those who are looking for higher returns. ICICI HFC offers higher rate of interest and at the same time flexibility allowing for effective compounding or liquidity depending on a depositor’s financial needs. ICICI fixed deposit is available for different tenure. The different tenure also affect the rate of interest as well. However, these deposits are easy to open and manage.

These fixed deposits are very safe and offer timely fulfillment of financial obligation. The ICICI HFC fixed deposits have given the highest rating of MAAA by ICRA and AAA (FD) by CARE respectively.

Important features and advantages of ICICI HFC fixed deposit

Icici Fixed Deposit Interest Rates

- ICICI HFC has the highest credit rate of AAA (FD) by CARE and MAAA by ICRA

- It offers flexible tenure to choose from 1 year to maximum 5 years

- The fixed deposit interest is compounded on yearly basis

- You can choose from monthly, quarterly or yearly compound interest as per your needs

- The minimum amount to deposit in ICICI HFC fixed deposit depends upon the saving scheme you have opted. However, it varies from minimum Rs. 10,000 to Rs. 40,000

- It offers nomination facility to the depositor

- No tax deduction will be made on interest paid Rs. 5000 in a financial year

- ICICI HFC offers 0.25% higher rate of interest for senior citizens

- It also offers loan facility against the fixed deposit of upto 75%

- Premature withdrawal facility

Premature withdrawal is not allowed for the initial three months.

In case of event of premature withdrawal, you have to follow the below term and conditions:

Icici Bank Fixed Deposit Close

| Premature Withdrawal | Rate of interest payable |

|---|---|

| After 3 months but before 6 months | For individual depositors the maximum interest payable shall be 4% p.a., and no interest in case of other category of depositors. |

| After 6 months but before 12 months | 2% lower than the minimum rate at which public deposits are accepted by ICICI HFC |

| After 12 months but before the date of maturity | 1% lower than the interest rate at which ICICI HFC would have paid had the deposit been accepted for the period for which such deposit has run. |

Fixed Deposit Rates In India

| Duration | Non cumulative Scheme | Cumulative Scheme | Extra Benfits | Who Can Invest? | |||

|---|---|---|---|---|---|---|---|

| Yearly | Half-yearly | Quarterly | Monthly | Interest | |||

| 12 Months | 8.20% p.a. | -- | 7.95% p.a. | 7.90% p.a. | 8.20%p.a | ||

| 15 Months | 8.20% p.a. | -- | 7.95% p.a. | 7.90% p.a. | 8.20%p.a | ||

| 20 Months | 8.25% p.a. | - | 8.00% p.a. | 7.95% p.a. | 8.25% p.a. | 0.25% extra for senior citizen across all slabs | Resident Individual, NRI, Trusts, Companies, HUF's, AOP |

| 30 Months | 8.25% p.a. | - | 8.00% p.a | 7.95%p.a. | 8.25% p.a. | ||

| 35 Months | 8.25%p.a. | - | 8.00%p.a | 7.95%p.a. | 8.25% p.a. | ||

| 40 Months | 8.50%p.a. | - | 8.25%p.a. | 8.20%p.a | 8.50%p.a. | ||

| 60 Months | 8.25%p.a. | - | 8.00%p.a. | 7.95%p.a. | 8.25% p.a. |